Situation Analysis

The periodical publishing industry is currently growing, although slightly. Major markets for this industry in the United States are New York, New York, Chicago, Illinois, Los Angeles, California, Washington, D.C., and Houston, Texas. The industry is currently suffering from the same problems that are affecting other specific industries within the broader media industry, such as loss of audiences and revenues, primarily due to the popularity of the internet and the industry’s struggle to adapt quickly enough. Despite these issues, however, magazines are still an influential platform, and it does seem like the industry will pull through.

Occupational data for this industry is limited. Specifically, for magazines, the only occupations the U.S. Bureau of Labor Statistics keeps data for that relate to this specific sector of the industry are writers and editors. As of 2018, writers and editors make an average salary of $63,510. Writers make a bit more on average, with an average salary of $62,170, while editors round out at an average salary of $59,480.

Within the periodical publishing industry, employees in Jefferson County, Colorado earned the highest wages in the second quarter of 2019, at a rate of $3,845 per week. In June 2019, there were 47 people employed in this county in the industry across 13 different establishments. This county induces the city of Denver. The second highest wages were found in Albany County, New York, followed by New York County, New York.

In New York County, employees earned an average weekly wage of $3,098. There were 14,511 periodical publishing industry employees in June of 2019, employed across 309 different establishments. As New York City is the publishing capital of the United States, it is unsurprising that so many people are employed there (U.S. Bureau of Labor Statistics, 2019).

The lowest wages in the country were found in Hidalgo County, Texas, at a rate of $247 per week. This is an interesting aspect, as one of the highest paying markets within the industry, Houston, is within the same state (U.S. Bureau of Labor Statistics, 2019).

Editors need a minimum of a bachelor’s degree and less than five years of experience to get a job in this occupation. Writers also need a bachelor’s degree, but do not need any experience, according to the U.S. Bureau of Labor Statistics.

Among writers, 61.5 percent are self-employed. For editors, this number is much lower, at 14.3 percent. This suggests that within the industry, many writers are now freelancing. Based on these data, editors seem much less likely to freelance in the current industry climate.

Although just barely, these occupations within the publishing industry do appear to be growing. The U.S. Bureau of Labor Statistics predicts that there will be a 0.4 percent rate of growth for these two professions between 2018 and 2028 (U.S. Bureau of Labor Statistics, 2018).

Major Industry Players

The publishing industry is primarily run by private corporations. As of the second quarter of 2019, there are 53,884 publishing companies in the United States (U.S. Bureau of Labor Statistics, 2019).

For the most part, the periodical publishing industry is still led by major household names that have been around for decades. In terms of audience size, the top ten are: ESPN The Magazine, People, WebMD, Allrecipes, AARP, Good Housekeeping, Better Homes and Gardens, Cosmopolitan, National Geographic, and Vanity Fair. This order changes slightly when considering online versions, as ESPN is still in first place, but WebMD receives more online readers than People (Watson, 2019).

Other big names, like New York Magazine, Us Weekly, Taste of Home, Vogue, Bon Appetit, Country Living, Reader’s Digest, and Southern Living are also industry leaders (Watson, 2019). The magazine that grew the fastest during 2018 was Motorcyclist, which experienced an average monthly growth of 73 percent, much of which can be attributed to growth among digital readers. Town and Country grew the next fastest at 68 percent. This growth was also primarily due to digital readers via mobile apps and the magazine’s website (Watson, 2019).

Reach of Popular Magazines in the United States in June 2019 (in millions)

Current Trends

At the moment, the industry appears to be growing, but it could also be starting to level out. From 2010 to 2015, employment in the publishing industry steadily declined. Employment was at 768,600 in January 2010 and reached a low in 725,900 in November 2015. Since 2015, employment in the industry has continually grown, reaching 768,700 in January 2020, which actually surpasses the highest rate of 2010. Steady growth in employment within this industry suggests that the industry overall is probably also growing. Employment rates ranged from 762,200 to 765,500 throughout 2019, so there may be some amount of plateauing occurring in the industry, also (U.S. Bureau of Labor Statistics, 2020).

One major factor affecting growth is the amount of new publishing companies that have come into existence in recent years. At the end of 2010, there were 34,660 publishing establishments in the United States. By the second quarter of 2019, this number had risen to 53,884 publishing establishments. If new organizations emerge within the industry, there will inevitably be a need for more people to work in each of those new companies.

The most pressing issues currently affecting the industry are the need to keep audiences engaged and the need to increase revenue. Without anyone to consume their content, magazine companies have little purpose to exist. A lack of engaged audience members also contributes to a lack of subscription sales, as well as advertising sales, as advertisers are looking to get the greatest number of eyes on their ads.

The ability to engage audiences is a major factor in any publishing company’s success. As society as a whole has changed so drastically in recent decades, publishers have had to adapt to reach audiences in new ways. To generate more interest from audiences, some magazine publishers are expanding their digital presence. Adapting to the changing nature of the industry, video is becoming increasingly important to magazines. In 2014, video made up 2 percent of content for magazines overall. In 2019, video accounted for 10 percent of content. This has increased audiences for video content by 425 percent (The Association of Magazine Media, 2019).

SWOT Analysis – Strengths/Weakness/Opportunities/Threats

Strengths

Big name publications like ESPN The Magazine are doing rather well. One aspect of this company’s success could come from the fact that it has a massive conglomerate, Disney, behind it to offer support. Another aspect of its success, more specific to the magazine’s own endeavors, is that ESPN The Magazine has embraced its digital components. A large driver of its massive audience is the fact that the magazine’s content is available online in an attractive, user friendly format. This makes it easy for audiences to share content via social media or to otherwise consume it as they wish.

The recent success of special interest magazines is another strength of the industry. This genre of magazine has been the fastest growing category for a few years in a row. Of all newly released magazines, special interest publications have also been the highest in number for many of the years between 2010 and 2018 (Watson, 2019). The strength of these niche publications is something that the industry should learn from and capitalize on.

Weaknesses

Declining revenue is the biggest weakness of this industry today. In 2007, the periodical publishing industry had an estimated revenue of $46 billion. That number was only $28 billion in 2017, signaling a dramatic decrease (Watson, 2019). This financial weakness within the industry is primarily due to the loss of valuable subscription dollars that have decreased as audiences moved towards digital publications and free online content.

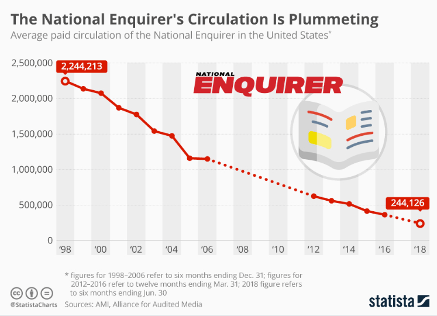

The National Enquirer stands out in the industry as one of the worst players right now. Beginning in 1998, the tabloid magazine has seen consistent losses in circulation. In 1998, circulation of The National Enquirer stood at 2,244,213. In 2018, 20 years later, circulation had dropped to a mere 244,126, leaving the magazine with about 10 percent of what its circulation once was (Richter, 2019).

There are many factors that may have contributed to the magazine’s demise. One issue could be that people are more aware in today’s culture and perhaps are not as interested in reading the blatantly false The National Enquirer is known for.

The magazine has also undergone lawsuits from major celebrities and important figures, such as Jeff Bezos, who sued the magazine in 2019 after representatives of the publication attempted to exhort Bezos with the publication of private photos (Culhane, 2019). This blunder certainly was not good for the bottom line of The National Enquirer. These types of celebrity conflicts, as well as the numerous political scandals the magazine has been embroiled with in recent years, can also alienate audiences.

Opportunities

If a company is willing to embrace change and creativity, opportunities in this industry are plentiful. A comprehensive digital strategy is key to a magazine’s success in the current economic climate.

Niche publications also provide opportunity within the industry. As stated above, Motorcyclist was the fastest growing magazine in 2018. This publication is catering to an incredibly specific audience, yet it has achieved success.

Perhaps not all, but many magazines can focus their resources on establishing themselves as the foremost publication on a certain topic, attracting engaged and loyal audiences, who would be more likely to subscribe. Since 2012, the number of Americans reading magazine has increased slightly (Watson, 2019). Magazine publishers have the opportunity to sustain and maximize this growth by catering to niche audiences.

Although advertising is one of the oldest revenue sources for magazines, it should not be overlooked as another area of opportunity. L’Oréal, Proctor & Gamble Co., Pfizer, Kraft Heinz, and Louis Vuitton were the highest spenders on magazine advertising in 2017, all spending hundreds of millions of dollars in magazines. L’Oréal spent a massive $700 million, followed by Proctor & Gamble, which spent $560 million (Watson, 2019). The revenue magazines bring in from advertising has decreased steadily but only slightly over the past decade. In 2019, advertisers spent $14.43 billion in magazine advertisements (Watson, 2019).

Magazine publishers should capitalize on advertisers’ continued interest in magazines as a platform and seek to expand that, either through replicating a similar system onto digital platforms, in a similarly aesthetic way as is seen on the pages of magazines, or by using the revenue they receive from advertisements to fund innovate projects that could turn into additional revenue sources.

Threats

The internet is without a doubt the greatest threat to this industry. Social media is a byproduct of this, which also threatens the success of the industry, “making it increasingly difficult for print newspapers and magazines to keep their audiences,” as “competition is becoming more and more fierce” (Watson, 2019).

Magazines can compete with the internet if they are willing to expand their digital profiles. As seen with the success of ESPN The Magazine, which has larger web and mobile audiences than it does a print audience, embracing technological advancements is the key to this industry neutralizing its biggest threat. Although magazines tend to feature more longform styles of writing, there is no reason the content cannot be adapted to fit social media and other digital platforms to expand audiences.

References

Culhane, J. (2019, February 8). Jeff Bezos Can Sue the Pants Off the National Enquirer. Politico Magazine. www.politico.com/magazine/story/2019/02/08/jeff-bezos-national-enquirer-pecker-ami-photos-224932

Richter, F. (2019, February 11). The National Enquirer’s Circulation Is Plummeting. Retrieved from https://www.statista.com/chart/16967/national-enquirer-circulation/

The Association of Magazine Media. (2019). Magazine Media 360° – A Five-Year Review of Magazine Brand Vitality. www.magazine.org/MPA/Research/Five_Year_Review/Magazine/Research_Pages/MM360_Whitepaper.aspx

U.S. Bureau of Labor Statistics. (2020). Quarterly Census of Employment and Wages Private, Periodical Publishers, All Counties (Publication No. NAICS 511120). https://data.bls.gov/cew/apps/table_maker/v4/table_maker.htm#type=1&year=2019&qtr=2&own=5&ind=511120&supp=0

U.S. Bureau of Labor Statistics. (2019). Occupational Projections and Worker Characteristics (Publication No. Unknown). https://www.bls.gov/emp/tables/occupational-projections-and-characteristics.htm

U.S. Bureau of Labor Statistics. (2020). Industries at a Glance, Publishing Industries (Publication No. NAICS 511). https://www.bls.gov/iag/tgs/iag511.htm#workplace_trends

Watson, A. (2019, August 27). U.S. Magazine Industry – Statistics & Facts. https://www.statista.com/topics/1265/magazines/